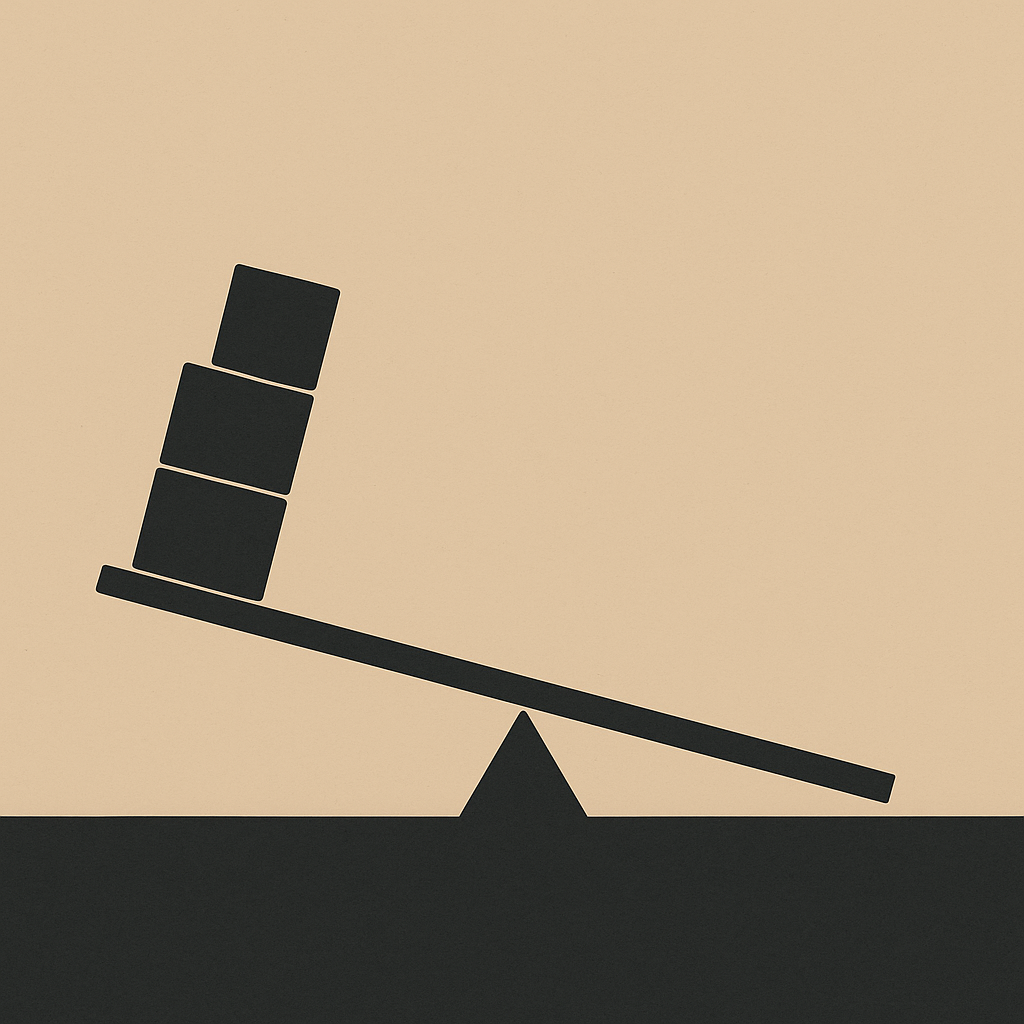

Markets are moving, but the uncertainty is not coming from markets alone. The system itself is wobbling. This creates a direct need for household risk math, because missing government data, mixed interest-rate signals, and platform instability are creating a new form of pressure on households. People feel the risk long before the numbers appear in a report. The practical question is simple. How do you protect a household when the public systems designed to create clarity are producing confusion instead?

The answer is not reaction. The answer is structure. When external volatility rises, private planning becomes a form of insurance. A household with steady routines and predictable financial behaviors becomes stronger than the environment around it.

The New Risk Environment and Household Risk Math

Traditional risk came from the economy. Today, risk comes from the systems that deliver information about the economy. Shutdowns erase data. Delays hide trends. Inconsistent policy language creates planning gaps. A household cannot make stable decisions with unstable inputs. Protection begins with reducing dependence on volatile signals and increasing reliance on internal systems.

Build Low-Volatility Routines

Simple financial structures perform well in unstable climates. Weekly expense reviews. Predictable bill cycles. Automatic savings. A short list of non-negotiables. These routines create clarity even when national indicators do not. Stability becomes something you generate instead of something you wait for.

Fiscal Footing

Reduce your exposure to variables you cannot control. Build routines that stabilize your cash flow regardless of policy swings.

Shorten the Planning Window

Households get in trouble when they plan for twelve months with information that may expire in twelve days. In a stability recession, shorten the horizon. Think in quarters, not years. It lowers emotional pressure and increases accuracy.

Protect Your Essentials

When the external system shakes, the essentials take priority. Food, rent, utilities, transportation. If these four stay protected, the household stays protected. Everything else is optional. Protection is not fear. Protection is order.

Receipts

Pew Research shows rising financial strain across demographics during periods of policy uncertainty, reinforcing the need for household-level buffers.

Pew Research

Do the Household Risk Math

List the risks. Quantify them. Assign responses. A risk that is named is easier to manage. A household that performs risk math regularly is harder to knock off balance. This is how you create clarity inside instability.

A practical example reinforces the point. The principle outlined in Discipline Before Dollars shows how internal order reduces vulnerability when external structures falter.

The Bottom Line

A stability recession demands private structure. Build the habits, shorten the planning window, protect the essentials, and calculate your risks. When the system shakes, structure becomes strength.