The China Plus One supply chain is rewriting the definition of “emerging markets.” For two decades, “emerging” meant growth potential: cheap labor, rising consumers, catch-up economics.

That definition no longer holds.

Instead, capital is pricing execution under pressure. It is choosing redundancy over concentration. It is rewarding regions that can absorb production without breaking.

The result is not a rotation. It is a redesign.

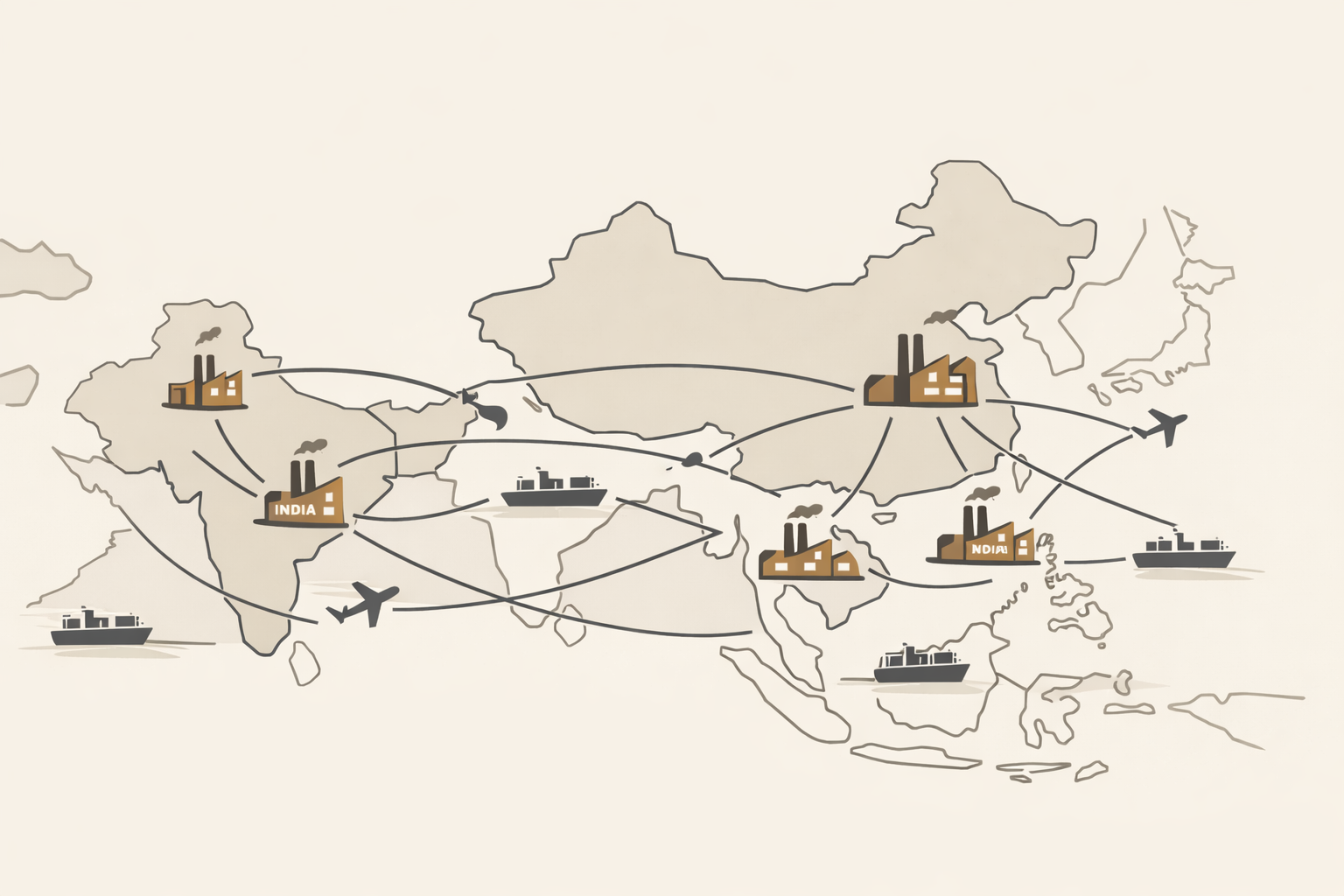

China Plus One supply chain: the end of the single-factory world

China is not collapsing. That storyline is lazy.

However, global manufacturing is being re-architected to survive political risk, tariff volatility, and concentration failure. After the last five years, no executive wants a balance sheet held hostage by a single geography.

This is where “China Plus One” moves from contingency planning to operating doctrine.

It is not about leaving China. It is about not being dependent on China.

That distinction matters.

Why India and Vietnam are winning China Plus One supply chain capacity

Capital follows capacity, not sentiment.

India is no longer being valued as a demographic story. It is being priced as an earnings-led industrial platform. Electronics assembly, defense exports, and manufacturing incentives have pulled it out of the “someday” category and into the “operational now” column.

Vietnam plays a different role: speed, precision, and process discipline. It is becoming the electronics factory floor for firms that cannot afford disruption. Export growth is not accidental here. It is the visible output of supply chain votes being cast quietly, contract by contract.

Indonesia completes the triangle by controlling materials rather than assembly. Nickel is not a commodity story. It is leverage. EV supply chains require it, and control shapes downstream pricing power.

These countries are not being rewarded for ideology. They are being rewarded for function.

FDI is the receipt: manufacturing has replaced finance as the signal

In the 2000s, capital markets told you where growth was headed. In the 2010s, technology platforms did.

Now manufacturing capacity does.

Factories take years to build. Supplier ecosystems take longer. Once capital commits, it does not pivot lightly. That is why foreign direct investment matters more than headlines. For a global benchmark, see UNCTAD’s latest investment report. UNCTAD World Investment Report (2024).

The quiet truth is this: supply chains are the new alliances. They outlast elections, survive rhetoric, and punish instability.

The new definition of emerging markets

An emerging market is no longer a place learning capitalism.

It is a place that can absorb displaced production, execute at scale, and remain politically legible to global capital. Growth is no longer enough. Control matters more.

This framing mirrors a core Groundwork principle: structure beats improvisation. Discipline Before Dollars.

This is not about optimism. It is about where the world is physically reorganizing itself.

The winners are not louder. They are busier.